About 504

504 Benefits

Occupancy costs are one of the biggest expenses for businesses, but you can make that line item work for you when you own your property instead of renting or leasing. If you’re thinking about purchasing or constructing commercial real estate for your business, there are plenty of great reasons why an SBA 504 loan is your best option.

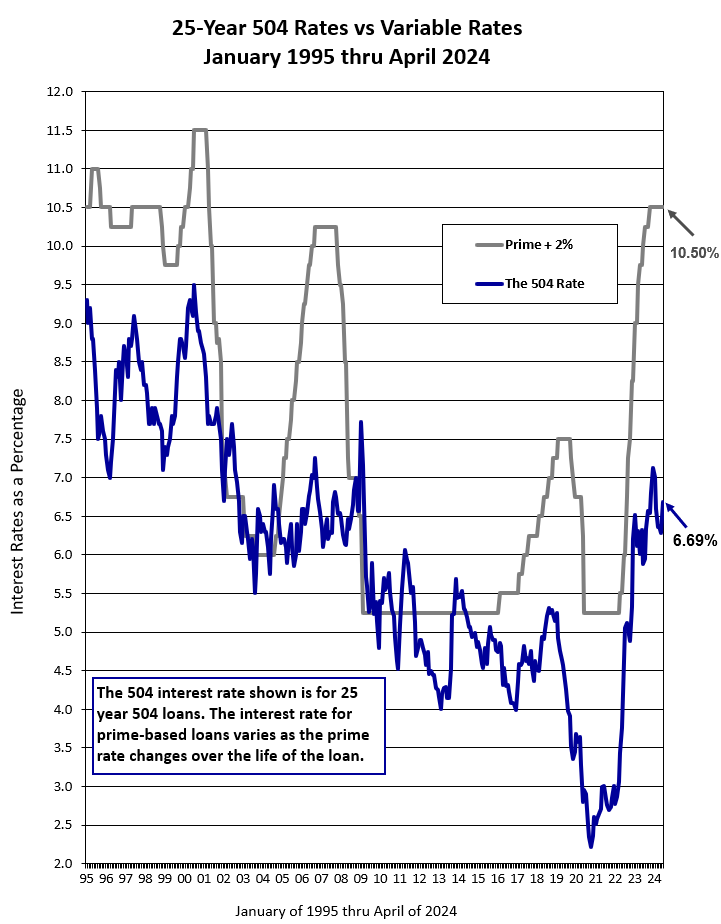

Fixed Long Term Rates

SBA 504 loans have fixed interest rates. Whether you choose a 10, 20, or 25 year loan, your interest rate will be locked in for the entire term of the loan. All SBA 504 loans are fully amortizing, without any rate adjustments, loan calls or balloon payments.

Below Market Rates

All SBA 504 loans of each term are funded from the same monthly pools and those economies of scale, combined with the SBA guaranty, work together to deliver fixed low rates that are typically well below conventional loan interest rates.

Low Down Payment

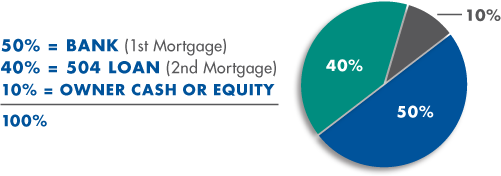

Whether your business is a newer venture or in growth mode, having more working capital at your disposal makes all the difference. SBA 504 financing offers up to 90% loan-to-value, making it one of the most affordable commercial real estate financing options you’ll find. Note that for companies less than two years old or for companies buying special purpose buildings, a minimum down payment of 15% is required.

Own Your Destiny

Owning your property puts you in control. Build equity, maximize tax benefits, and lock in your occupancy costs for a generation, all to give your company every advantage it deserves.

Interest Rates

The primary benefit that makes SBA 504 loans so attractive is the low fixed interest rate, which is determined monthly. The current monthly rates are:

| 504 LOAN* | |

|---|---|

| 25-year rate: | 6.69% |

| 20-year rate: | 6.76% |

| 10-year rate: | 6.58% |

504 Refinancing carries interest rates that are .025% higher than regular 504 rates for each respective loan term. 10-Year SBA 504 loans fund every other month. 10-Year rate above is for March 2024.

Clients often ask us how the SBA can offer such favorable financing. Here’s how it works.

Many lenders refer to the SBA 504 loan program as “The Small Business Window to Wall Street” because it gives small and mid-sized companies access to and the benefits of large-scale corporate capital markets. All 20 and 25-year SBA 504 loans are funded each month in separate loan pools of SBA guaranteed securities. The economies of scale from loan pools of hundreds of millions of dollars, combined with the SBA guaranty, give 504 borrowers the best long term fixed rates available so they can purchase commercial real estate and/or make capital improvements to their owner-occupied commercial property.

504 loans can also be issued with a fully amortizing term of ten years. These shorter-term loans usually finance heavy machinery and equipment. ten year 504 loan pools are issued every other month instead of every month and carry great low interest rates which are fixed over their ten year term.

To have the new 504 rate emailed to you as soon as it is established each month, simply submit your email address here.

FAQs

How can 504 Funds Be Used?

504 loans finance commercial real estate, other fixed assets including land, and capital equipment for small and mid-sized companies that will be the primary occupants or users of the property being financed. Companies buying existing buildings must occupy at least 51% of the net rentable space.

504 loans may also be used for:

- Building construction or remodeling. Companies constructing new buildings must initially occupy at least 60% of the space, with the intent to occupy additional space within three years and up to 80% of the building space within ten years.

- Transaction costs such as SBA 504 fees, bank interim loan fees, and other transaction costs can be included in the financing, provided they are supported by the project property appraisal.

- Capital equipment with a sufficient economic life, including production equipment and even solar power systems, qualify for 504 financing.

How are SBA 504 projects structured?

A conventional loan from a bank, credit union or other commercial finance lender usually provides 50% of the overall project financing in a first lien position. The SBA 504 loan typically provides up to 40% of the project financing in a second lien position. The buyer provides a minimum 10% down payment.

504 loans make up 40% of a project or $5 million for most projects, and up to $5.5 million for manufacturing companies and for projects that produce renewable energy. Projects from $300,000 to $25 million or more are viable SBA 504 financing candidates.

SBA 504 loans are take-out or permanent financing. As a result, the lender providing the 1st mortgage loan also provides interim financing of the SBA 504 portion of the loan for projects including remodeling or construction, or a short term bridge loan to facilitate a quick close for building purchase projects without construction. The SBA 504 loan provides funds to pay off the interim or construction financing.

What are the terms of a 504 loan?

SBA 504 real estate loans are 20 or 25 year, fixed-rate, fully amortizing loans. SBA 504 loans with ten-year, fully-amortized fixed-rates are available for projects involving the acquisition of capital equipment with at least a ten year economic life.

The SBA 504 interest rate is fixed over the term of the loan at the time of 504 loan funding. The rates are market-determined and 20 and 25 year 504 loans are typically priced at the ten-year U.S. Treasury rate plus a spread of 1.75% to 2.5% (please see the Current 504 Rate Page). SBA 504 loans with ten-year terms are typically priced at the five-year U.S. Treasury rate plus 2% to 2.25%.

SBA 504 fees are financed with the overall project and include 2.15% of the 504 loan plus a $2,500 loan closing fee. 504 loans are fully amortized and have no balloon payments or call provisions. 504 loans have a formula prepayment penalty for the first 10 years for 20 & 25 year 504 loans and for the first 5 years for 10 year 504 loans. Note that the bank making the first mortgage loan also pays an SBA fee of ½% of the first mortgage loan amount, and this fee is normally passed on to the borrower.

What are the terms of the conventional (bank) loan?

The bank loan carries market rates and fees and may be structured as a fixed or variable rate loan. To participate with a 20 or 25 year 504 loan, the bank loan must have a term of least ten years. To participate with a ten-year 504 loan, the bank loan must have a term of at least seven years. The bank is also required to pay a participation fee of ½% of the project first mortgage loan to the SBA, which is typically passed on to the borrower. A complete funding proposal is prepared by Bay Area Development Company for use by the bank and the SBA, and the client negotiates the bank rate and terms.

Is my company too big or too successful for an SBA 504 loan?

504 loans are designed for successful, growing companies. In fact, most privately held, for-profit companies are eligible for SBA 504 financing. You must have a proven ability to repay the financing, but well-structured new ventures may also qualify. Contact our staff for details.

How do I apply for a 504 loan?

Bay Area Development Company can pre-qualify you for a 504 loan in 24 to 48 hours at no cost to you and with basic project and financial information. Simply contact one of our loan officers to discuss your project. We can also pre-qualify your company for an estimated project amount before you have identified the specific property you wish to purchase. Our SBA 504 Loan Calculator will generate an instant quote for your project and show how 504 financing can work for your business.

504 Loan Calculator

Curious to see how a 504 loan can work for your project? It takes just a few minutes to provide us with some details about your company and your project and then we’ll give you a sample SBA loan structure on the spot, including estimated down payment, estimated loan terms and monthly payment estimates.

BVR Index

BVR stands for Buy Versus Rent, and we created the BVR Index in response to clients asking what it would cost to purchase commercial property instead of continuing to lease or rent. This formula crunches the numbers, and in many cases, business owners are happily surprised to find that their goal of buying is well within reach and may even cost them less than leasing. As an example, today’s BVR Index is 6,370, which means that if you financed your project with a 25-year 504 loan this month, your estimated monthly mortgage payment would be $6,370 per million dollars of project cost. The BVR Index assumes that:

- Your project qualifies for the standard 504 90% financing. Please note that special purpose properties and companies less than two years old require higher down payments.

- You or your company will provide 10% of the project cost as the required cash/equity contribution.

- SBA 504 loan fees are included in the project cost and in the SBA 504 loan calculations.

- A typical market bank interest rate and bank loan amortization of 25 years have been used for estimating purposes.

- Your loan will fund at the current SBA 504 rate, which changes each month and impacts the BVR index accordingly.

If you’re spending too much in rent or lease payments and want to explore how 504 can work for you, our 504 loan team can put you in control.

Historic Rate Chart